washington state long term care tax opt out requirements

Enter your current age. Youll need to show your employer and future employers a letter from the state that says your exemption has been approved to avoid the tax.

21 Awesome Products From Amazon To Put On Your Wish List Pen Colored Pens Fineliner Pens

We encourage workers to compare the state programs lifetime benefit requirements for the plans use and the payroll deduction of 58.

. Washington was prepared to roll out this program at the beginning of the year but the new bills have delayed the timeline by 18 months. An individual will have one opportunity to opt out by purchasing comparable or better long-term care insurance by November 1 2021. In that case the tax will be permanent and mandatory.

Yes an employee may opt-out of the Washington Long-Term Care Program and its taxes and benefits if. At least 18 years of age. A bill that moves up the deadline for employees to opt out of the states upcoming long-term services and supports program and its associated payroll taxes is on its way to the Governor.

The move follows a frenzy of interest in the costly insurance policies prompted by a November 1 deadline to opt out. You will need to have private long-term care insurance in place by November 1 2021 and then apply for exemption. There will be a one-time window of opportunity to permanently opt-out of the WA Cares Fund.

Once you opt out you cannot opt back into the program ie the opt-out is permanent. Even though our members at Boeing are excluded from the Washington State Payroll Tax this year due to being in a Collective Bargaining Agreement in effect on October 19 2017 the Washington State Long Term Care law offers a one time opt-out where you must have an approved alternate plan in place. Attest that you are.

This is a permanent opt-out once out you cannot opt back in. To be eligible to receive long term care benefits under the WA Care Fund an individual must meet one of the following contribution requirements. Visit our exemptions page to see if you meet all of the requirements.

For your safety and security we need to verify your identity when you submit your exemption application. Beginning on January 1 2022 employers will initiate payroll deductions for the WA Cares Fund designed to make long-term care LTC affordable for all state residents. Now workers in Washington wont see this deduction from their paychecks until July 2023 at the earliest.

November 1 2021 is the deadline to avoid the new tax by purchasing a private long term care policy. Earlier this year we shared the details and planning implications of Washington States new long-term care tax the first such law passed in the United States. You can opt-out permanently if you have your own long-term care insurance policy in place before November 1 2021 that provides equal or better benefits.

Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline. You may need to upload proof of identity if you have not done so in the past under the Secure Access WA system. You must then submit an attestation that.

Any traditional employee must opt out in order to avoid the payroll tax on all Washington state compensation for as long as the program is in existence. Washington State is accepting exemption applications between October 1 2021-December 31 2022. First to opt out you need private qualifying long term care coverage in force before November 1 2021.

Next steps ESD will review your application and notify you if youre eligible for an exemption from WA Cares coverage. Long-term care insurance companies have temporarily halted sales in Washington. Individuals must meet specific requirements to qualify for an exemption.

Have long-term care insurance purchased before 1112021. This is also true if you move to Washington state after the opt out window closes after 12312022 and you didnt already own long-term care insurance with a policy date. The states website about the program called the WA Cares Fund is here.

1 employees will pay 58 cents for every 100 earned to fund up to 36500 in benefits for individuals to pay for home health care and other services. AWC partnered with other organizations and employers to successfully push back the opt-out date to November 1 2021 to allow employees more time to. Washington state workers who.

Unfortunately it is not clear EXACTLY what coverage will guarantee exemption from the tax. Between October 1 st 2021 December 31 st 2022 you will need to complete and file a waiver application with the state attesting that you have other long-term care insurance. You also need to consider your age how long until retirement and much more.

What qualifies as LTC Insurance for the purposes of exemption. A rider that specifies its benefits pay for long-term care services as opposed to a lump sum or payments to be used at the discretion of the insured can be considered LTC insurance. Make sure youre fully prepared.

Each beneficiary can access up to 36500. Submit an exemption application to the Employment Security Department ESD. For more information about what kind of private insurance qualifies for the exemption visit the Washington State Office of the Insurance Commissioner website.

Create a SecureAccess Washington SAW. Be at least 18 years of age. An employee is temporarily vested if they have worked a minimum of 500 hours per year for three years within the last six years from the date of application of benefits.

WA Cares Fund is a long-term care insurance tax of 058 of gross wages of workers in the state of Washington. Exemption applications became available on Oct. Yes all employees in Washington State will be required to participate by this WA Cares Fund by paying a 058 per 100 in salary assessment.

The employee is 18 years old or older on the date they apply for the exemption. Wish to opt-out of participating in the WA Cares Fund Program. The employee attests that they have other long-term care insurance.

Washington State Long-Term Care Tax. Opting out of the tax must be done by November 1 2021 and you must buy qualified private long-term care insurance to get out of the public program. ESD can only accept exemption applications through Dec.

Under current rules in order to opt-out of the payroll tax Washington state residents will need to secure LTC Insurance coverage by November 1st of 2021. Get a Free Quote. To qualify as LTC in Washington state a long-term care rider attached to a life insurance or annuity policy must pay a benefit dedicated to cover long-term care services.

New Wa Long Term Care Tax Delayed So Legislature Can Fix It Crosscut

Answering Your Questions About Wa Cares A First In The Nation Long Term Care Benefit Steve Tharinger

Washington State S New Long Term Care Statute Is A Mess Can Erisa Preemption Provide The Cleanup Employment Advisor Davis Wright Tremaine

Wa Cares Ltc If You Opt Out And Fail To Present The Opt Out To A Future Employer They Will Tax Long Term Care Insurance Long Term Care Private Insurance

Is Long Term Disability Insurance Taxable Trusted Choice

Pdf They Deserve Better The Long Term Care Experience In Canada And Scandinavia

Is Long Term Disability Insurance Taxable Trusted Choice

How To Pay For Nursing Homes Assisted Living

Is Long Term Disability Insurance Taxable Trusted Choice

Changes To Wa Cares Fund Likely Next Session Washington State Wire

Lincoln Financial Long Term Care Insurance Reviews Retirement Living

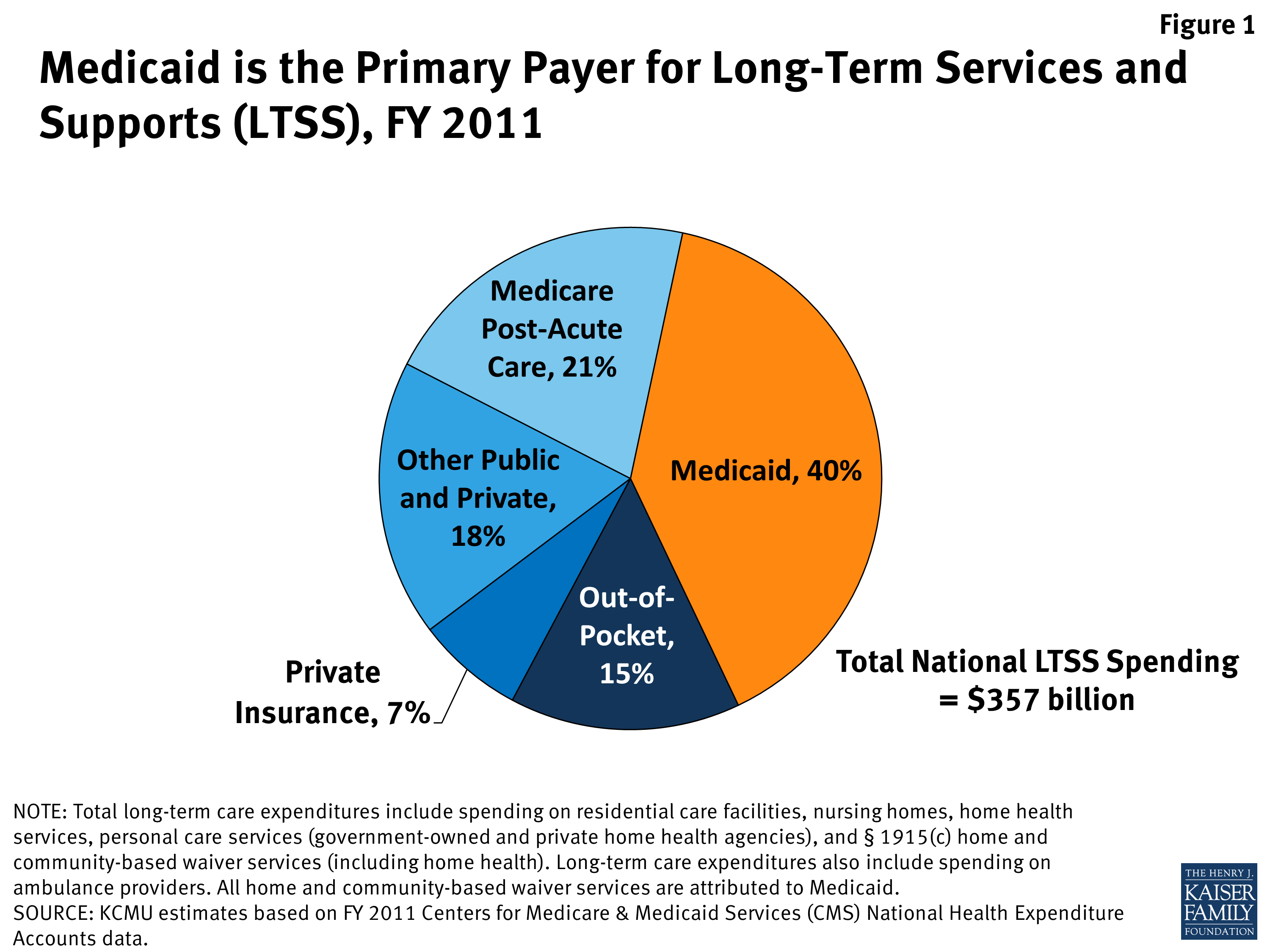

The Affordable Care Act S Impact On Medicaid Eligibility Enrollment And Benefits For People With Disabilities Kff

Answering Your Questions About Wa Cares A First In The Nation Long Term Care Benefit Steve Tharinger